Some Ideas on Personal Loans Canada You Should Know

Some Ideas on Personal Loans Canada You Should Know

Blog Article

Fascination About Personal Loans Canada

Table of ContentsPersonal Loans Canada Fundamentals ExplainedSome Ideas on Personal Loans Canada You Should KnowPersonal Loans Canada Can Be Fun For Everyone9 Easy Facts About Personal Loans Canada ExplainedAll About Personal Loans Canada

This suggests you have actually provided each and every single dollar a work to do. placing you back in the motorist's seat of your financeswhere you belong. Doing a routine budget will offer you the confidence you need to handle your cash successfully. Good points pertain to those who wait.Yet saving up for the large points means you're not going right into financial obligation for them. And you aren't paying extra over time because of all that rate of interest. Count on us, you'll enjoy that family members cruise or play ground set for the children way a lot more knowing it's currently spent for (rather than paying on them till they're off to college).

Absolutely nothing beats comfort (without debt of program)! Financial obligation is a trickster. It reels you in just to hang on for dear life like a crusty old barnacle. You do not have to transform to individual financings and financial debt when points obtain tight. There's a much better means! You can be without financial debt and start making genuine grip with your cash.

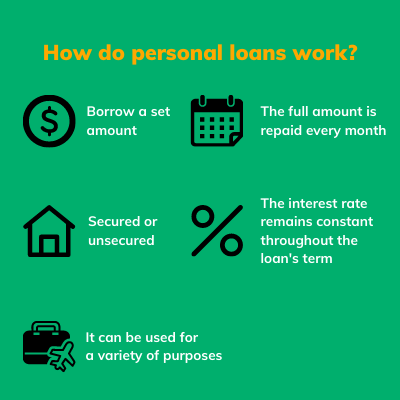

They can be safeguarded (where you provide security) or unsafe. At Springtime Financial, you can be approved to obtain cash approximately lending amounts of $35,000. A personal car loan is not a line of credit scores, as in, it is not revolving funding (Personal Loans Canada). When you're approved for a personal car loan, your loan provider gives you the sum total at one time and after that, usually, within a month, you start payment.

How Personal Loans Canada can Save You Time, Stress, and Money.

Some banks placed specifications on what you can use the funds for, but numerous do not (they'll still ask on the application).

The need for individual finances is increasing amongst Canadians interested in leaving the cycle of payday lendings, consolidating their debt, and rebuilding their credit rating. If you're using for a personal car loan, here are some points you must keep in mind.

Rumored Buzz on Personal Loans Canada

Furthermore, you could be able to decrease how much total passion you pay, which suggests even more money can be saved. Individual financings are effective tools for accumulating your credit history. Settlement background accounts for 35% of your credit history, so the longer you make routine payments on time the extra you will certainly see your score rise.

Personal lendings give a wonderful chance for you to rebuild your credit history and pay off financial obligation, but if you do not budget appropriately, you could dig on your own into an also much deeper hole. Missing out on one of your month-to-month repayments can have a negative effect on your credit report yet missing several can be devastating.

Be prepared to make every payment on time. It's real that a personal loan can be utilized for anything and it's much easier to get accepted than it ever read the article before was in the past. If you don't have an urgent demand the additional cash, it might not be the ideal solution for you.

The taken care of month-to-month repayment amount on a personal car loan depends upon just how much you're obtaining, the rates of interest, and the fixed term. Personal Loans Canada. Your rate of interest will depend on elements like your credit rating and revenue. Typically times, individual lending rates are a whole lot lower than bank card, but sometimes they can be greater

An Unbiased View of Personal Loans Canada

The market is great for online-only loan providers loan providers in Canada. Benefits include excellent rate of interest, unbelievably quick handling and financing times & the privacy you Read More Here may desire. Not everybody likes walking into a financial institution to request for money, so if this is a hard area for you, or you simply do not have time, taking a look at on the internet lenders like Spring is a great choice.

Repayment lengths for personal lendings generally fall within 9, 12, 24, 36, 48, or 60 months (Personal Loans Canada). Much shorter payment times have really high regular monthly repayments yet after that it's over quickly and you do not shed more money to passion.

Personal Loans Canada Can Be Fun For Anyone

Your interest price can be linked to your payment duration. You might obtain a reduced interest rate if you finance the lending over a shorter duration. An individual term financing includes a set settlement schedule and a repaired or floating rate of interest. With a drifting rates of interest, the interest amount you pay will certainly rise and fall month to month based on market changes.

Report this page